November 8, 2019

Market Developments

- After some serious harvest delays, it appears most, if not all, of the 2019 mustard crop will make it off the field. As of October 28, 97% of provincial mustard acres had been harvested and further progress was made since that report.

- In our previous report covering mustard, we expressed some skepticism about the high Sask Ag yield estimates but we’ve received some feedback that the 2019 crop has performed surprisingly well.

- We’re not quite prepared to boost yields above 1,000 lb/acre but we’re pegging the 2019 crop at 165,000 tonnes, just 5% smaller than last year despite a 21% decline in seeded area. Together with the larger old-crop carryover, 2019/20 supplies would end up at 245,000 tonnes, up 10,000 from last year.

- The quality of the crop could play a role in export potential but on the surface, there should be adequate supplies to match last year’s export program.

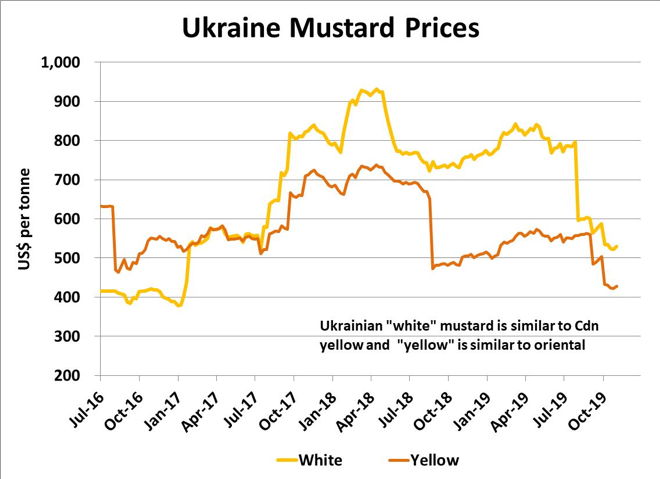

- While there are still questions about the possibility of lower Black Sea mustard yields in 2019, prices in Ukraine are demonstrating the opposite. Initially, prices dropped hard in August during the shift from old-crop to new-crop pricing. Since then, prices have continued to slide, suggesting that 2019 yields aren’t a concern and supplies are comfortable. If so, this would limit the opportunity for Canadian mustard exports into the EU and possibly Asia.

Outlook

Aside from some normal seasonal gains, there hasn’t been much movement in Canadian mustard bids. This seems to confirm ideas that the 2019 crop wasn’t damaged as significantly as expected earlier. This solid performance doesn’t mean bids have room to weaken though, as long as farmers can remain patient sellers. The most likely direction in the short-term is sideways to slightly firmer in line with typical price movement at this time of year but once buyers need to shift attention to uncontracted supplies later in 2019/20, bids will see more upside.